haven't filed state taxes in 10 years

Tax evasion in California is punishable by up to one year in county jail or state prison as well as fines of up to 20000. According to the statement the IRS usually looks for tax records dating to six years.

How Do I File Returns For Back Taxes Turbotax Tax Tips Videos

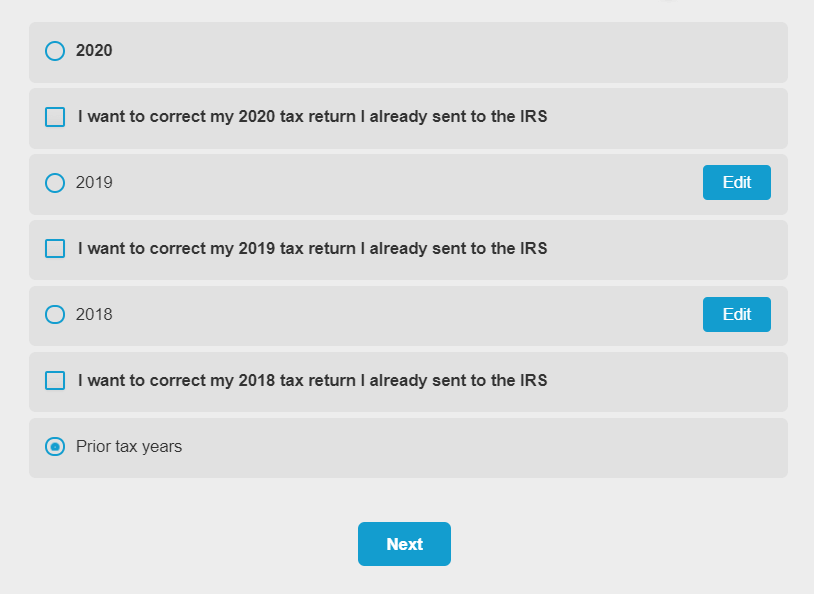

For example if you need to file a 2017 tax return.

. File electronically when youre ready. Step 3 Gather the financials to complete your tax forms. You canand shouldstill file your past three years of tax.

According to the cra a taxpayer has 10 years. My income is modest and I will likely receive a small refund for 2019 when I file. In order to qualify for an IRS Tax Forgiveness Program you first have to owe the IRS at least 10000 in back taxes.

In the event that you havent filed or paid taxes in quite some time be ready to cough out hefty fines. I havent filed taxes in over 10 years. You cant seek a refund for the returns that more than three years ago.

Contact the CRA. The timeframe for claiming a refund is normally three years after the tax return is filed or two years after the taxes are paid. If you or someone you know have not filed their taxes with the IRS or Minnesota Department of Revenue.

So if you are owed money and did not file taxes you must act within the 3-year period to receive. Then you have to prove to the IRS that you dont have the means to pay. If you owed taxes for the years you havent filed the IRS has not forgotten.

For over 30 years WATAX solves every kind of tax problem from unfiled returns to negotiating balances due. If you dont file a tax return you will be in violation of the law. If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for.

If you havent filed in years and the CRA has not yet contacted you about your late taxes apply to the Voluntary Disclosure Program as soon as possible. Its too late to claim your refund for returns due more than three. Please feel free to email or call me.

Penalties include up to one year in prison for each year you fail to file and fines of up to 25000 for each year you fail. That said youll want to contact them as soon as. For each return that is more than 60 days past its due date they will assess a 135 minimum failure to.

If your bookkeeping got a bit lax during the last 10 years for which you have unfiled tax returns youll need to do some. Call us at 1-888-282-4697 or email us a description of your tax issue and well. For example if you need to file a 2017 tax return.

Havent Filed Taxes in 10 Years. This helps you avoid prosecution for. Joe Alabi EA MAcct Taxation FishCoin Tax.

Havent Filed Taxes in 10 Years If You Are Due a Refund. If the CRA hasnt been trying to contact you for the years that you havent filed taxes consider that a good sign. I dont own a home I have no investments.

Penalties such as failure to pay taxes and failure to file taxes can amount up to. If you file your tax return the statute of limitations prevents the IRS from conducting an audit of your taxes for a particular year after 3 years have passed since you filed that return.

Tax Deadline These Last Minute Tax Tips Are Worth Knowing

What Happens If You Don T File A Tax Return Cbs News

How To Check A Prior Year Tax Refund Status Priortax

What Happens If I Haven T Filed Taxes In Years In California

How To Contact The Irs If You Haven T Received Your Refund

Here S What Happens If You Don T File Your Taxes Bankrate

I Haven T Filed Taxes In 10 Years Or More Am I In Trouble

Unfiled Tax Returns 12 Irs And Nys Must Know Faqs

What Is A W 2 Form Turbotax Tax Tips Videos

Amazon Com Turbotax Home Business 2021 Tax Software Federal And State Tax Return W Federal E File Amazon Exclusive Pc Mac Disc

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Can T File Your Tax Return By Midnight Here S How To File A Tax Extension Cnet

Unfiled Tax Returns 12 Irs And Nys Must Know Faqs

How To File Back Taxes On F J M Q Visas Filing Prior Year Tax Returns

Don T Count On That Tax Refund Yet Why It May Be Smaller This Year

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

I Haven T Filed Taxes In 10 Years 6 Years Forever Southwest Minneapolis Mn Patch